Charitable Contribution Limits 2025. Most of the relevant tcja changes are effective for 2018 through 2025. When you donate money to a qualifying public charity, you can deduct up to 60% of your income, alleviating your tax burden.

You then keep the money in. Subject to certain limits, individuals who itemize may generally claim a deduction for charitable contributions made to qualifying charitable organizations.

HSA Contribution Limits for 2025 and 2025, Subject to certain limits, individuals who itemize may generally claim a deduction for charitable contributions made to qualifying charitable organizations. Indexes the current limit (up to $100,000) for qualified charitable distributions (qcds) to adjust for inflation.

Higher CatchUp Contribution Limits in 2025 YouTube, Here are the 2025 standard deductions compared to the 2025 tax year: For 2025 and later, limits are 60% of the taxpayer’s adjusted gross income (agi), although.

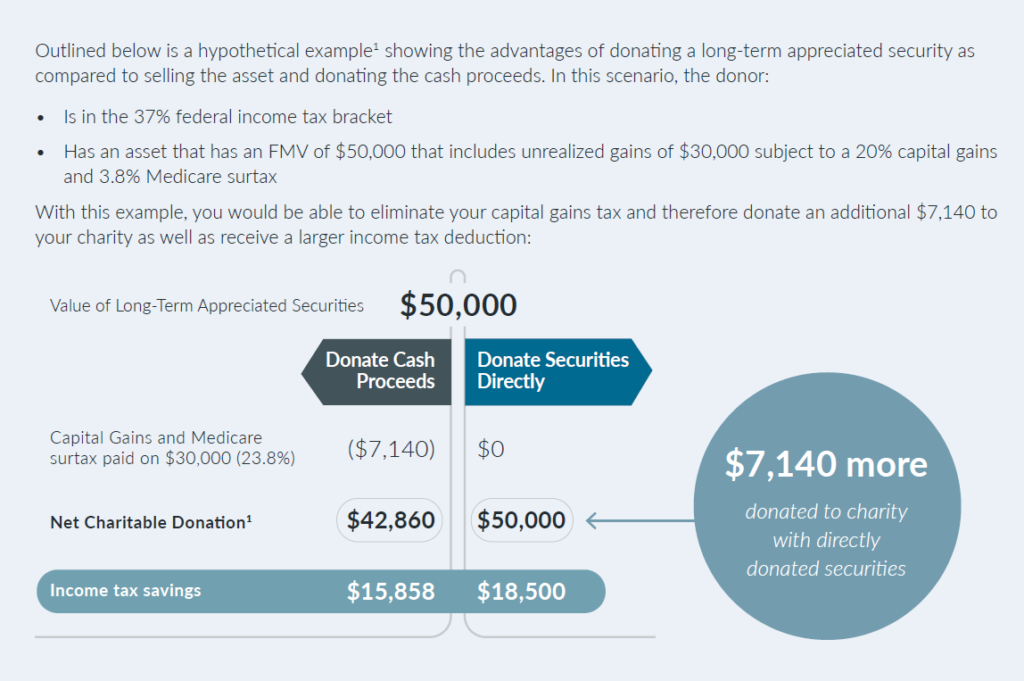

WAM's Guide to Giving Weatherly Asset Management, What are the charitable contribution limits for 2025 and 2025? You then keep the money in.

2025 Charitable Contribution Limits Darcy Melodie, In 2025, the total contribution limit is projected to be $71,000. Indexes the current limit (up to $100,000) for qualified charitable distributions (qcds) to adjust for inflation.

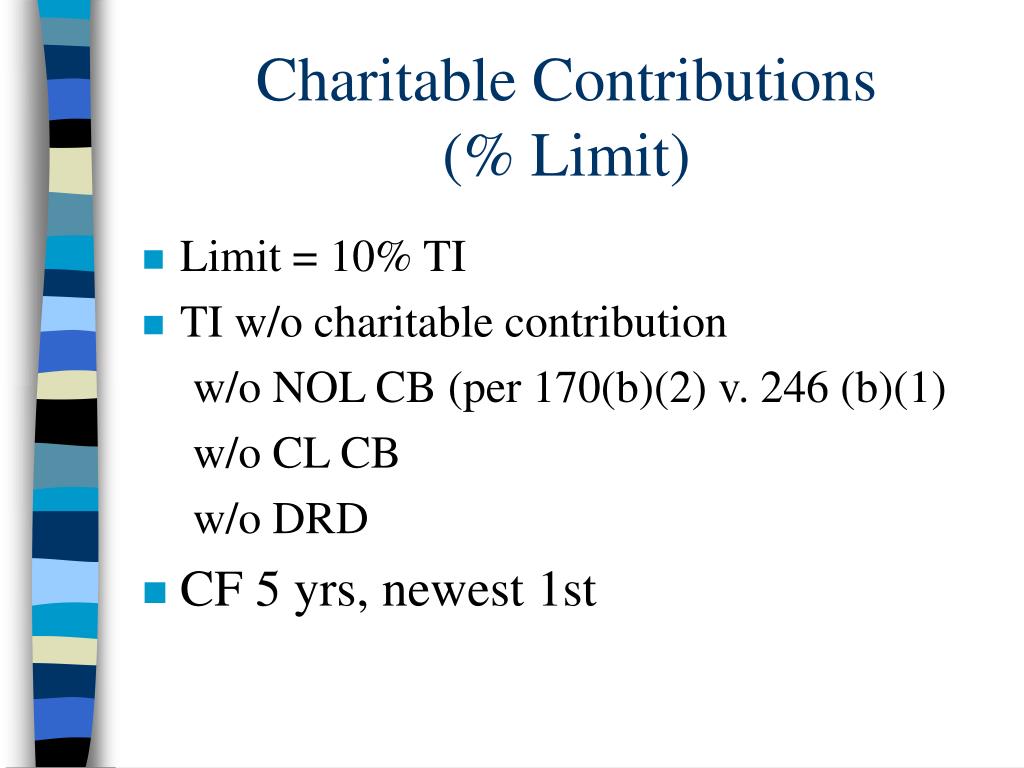

Deductions and Losses Certain Itemized Deductions ppt download, These limits typically range from 20% to 60% of adjusted gross income (agi) and vary by the type of contribution and type of charitable organization. Here’s what you need to know.

, Here are the 2025 standard deductions compared to the 2025 tax year: Taxpayers who itemize can deduct the value of their contributions to qualifying charitable organizations.

.jpg)

PPT Chapter 16 Corporations PowerPoint Presentation, free download, In 2025, the total contribution limit is projected to be $71,000. What qualifies as a charitable donation?

Roth Ira Contribution Limits Calendar Year Denys Felisha, Indexes the current limit (up to $100,000) for qualified charitable distributions (qcds) to adjust for inflation. These limits typically range from 20% to 60% of adjusted gross income (agi) and vary by the type of contribution and type of charitable organization.

The Benefits Of A Backdoor Roth IRA Financial Samurai, What about other ways to maximize my charitable deduction? The charitable contribution limits depend on what kind of contribution you’re making.

2025 Hsa Family Contribution Limits Layne Myranda, For 2025 and later, limits are 60% of the taxpayer’s adjusted gross income (agi), although. Here’s what you need to know.

Your deduction for charitable contributions generally can’t be more than 60% of your agi, but in some cases 20%, 30%, or 50% limits may apply.